Insurance

Term Life Insurance

As the name suggests, term life insurance protects policyholders for a certain tenure of 10 to 25 years. The beneficiaries receive the premium if the policyholder expires during this tenure. It's the most economical kind of life insurance, providing pure risk coverage, and offers a sizable guaranteed sum for the lowest price.

Whole Life Insurance

Whole life insurance guarantees that beneficiaries receive a death benefit anytime during their lifetime, providing coverage that never ends. It provides promised premium sum, cash value accumulation, and lifetime coverage to the policyholders. This insurance offers long-term financial coverage and security as it even pays for funeral expenses.

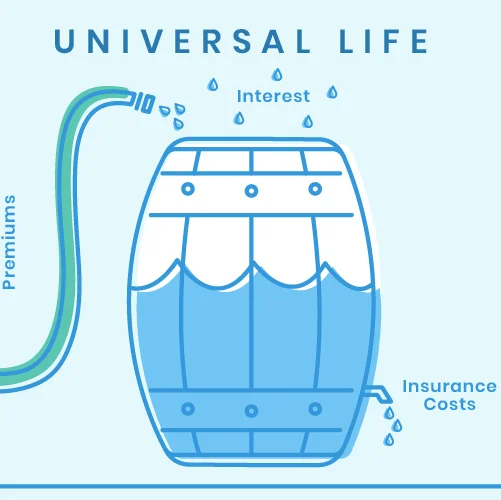

Universal Life Insurance

Universal Life insurance (UL) is a type of permanent life insurance with adjustable premiums, loan alternatives, and an investment savings component. It can be more affordable than whole life insurance since they offer the ability to adjust rates within certain restrictions. These policies can easily be customized to policyholders’ needs.

Group Life Insurance

Many big organizations, like associations or labor unions, provide group life insurance to their employees. It is frequently provided as a component of a membership benefit and has a comparatively low coverage level. It is an affordable choice for companies looking to provide life insurance as a vital benefit to the employees.

Policy Review

Let our financial experts review your policies and Increase policy potential and coverages and returns! For best outcomes, our staff will examine your rules and make sure they comply with industry norms. With us today, you can maximize your approach and obtain peace of mind and security.

Mortgage Protection

Mortgage insurance shields a mortgage lender in the event that the borrower dies, falls behind on payments, or is otherwise unable to fulfill the terms of the mortgage agreement. Count on us to protect your property with the right policy and apt investment offering security over mortgages.

Future Income Planning

A plan is the first step towards achieving your goals. At Globe Integrity, our financial advisors can assist you in reviewing your plan and making any required changes in policies to help you in future as your life and the markets change. Put your trust in us to develop a customized plan for your future.

Disability Insurance Policy

Disability insurance is a type of coverage that pays benefits in the event that an insured person's handicap prevents them from working and earning a living. Getting your disability insurance today can support you through uncertain difficult times and can help you keep your lifestyle without experiencing severe financial challenges.

Talk to our insurance experts

Our Experts are available 24 X 7 to help. They are just one call away. Make the call now and Let our expert handle all your Insuarnce Quries.